How Americans define a middle-class lifestyle — and why they can’t reach it

,

and

February 15, 2024 at 9:57 a.m. EST

About 9 in 10 U.S. adults said that six individual indicators of financial security and stability were necessary parts of being middle class in the Post poll. Smaller majorities thought other milestones, such as homeownership and a job with paid sick leave, were necessary.

“Middle class-ness and predictability are very tied in the American imagination,” said Caitlin Zaloom, an anthropology professor at New York University. “Sometimes that is about security in the present, but it also means feeling secure about where life is going.”

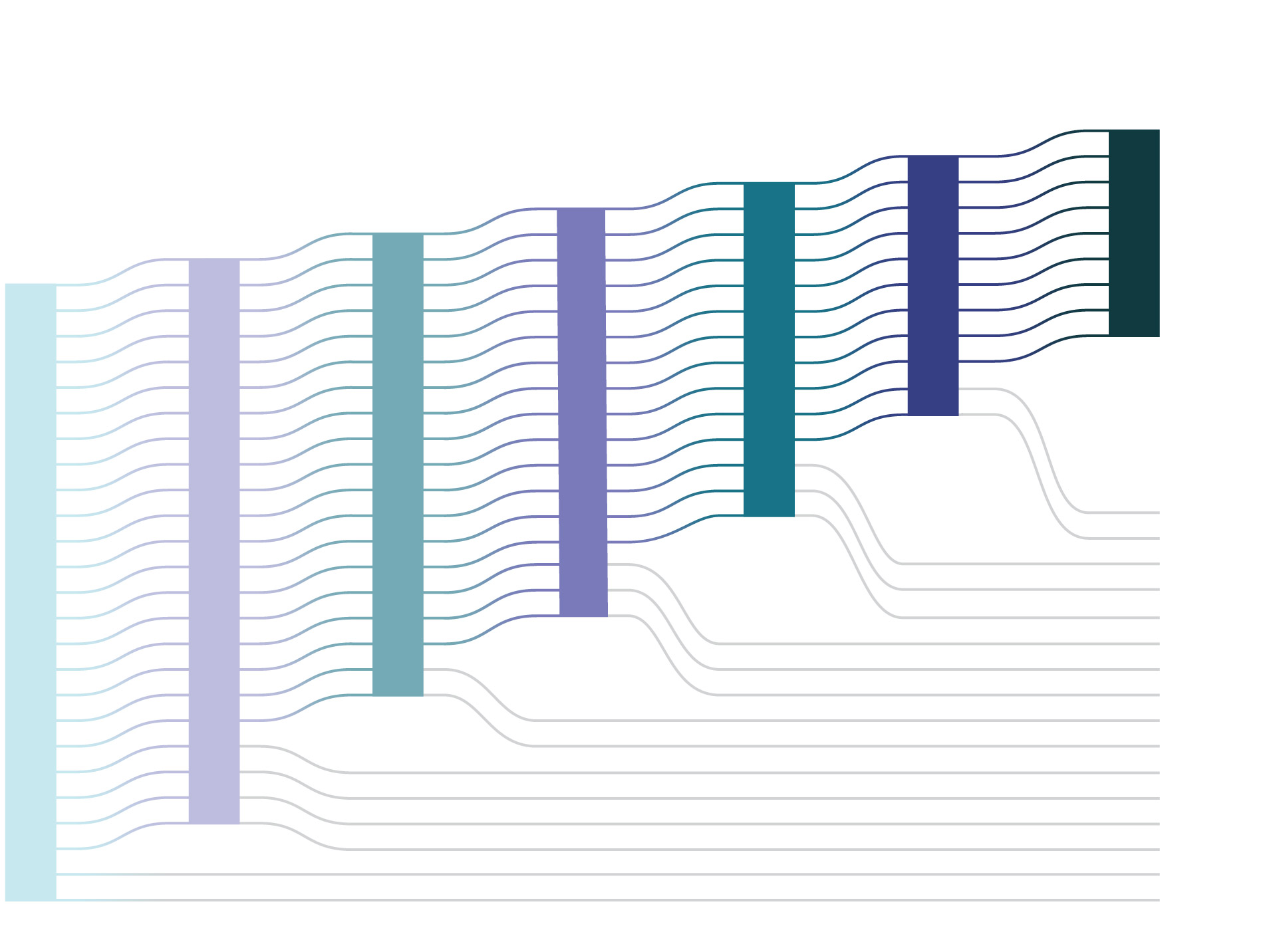

Just over a third of Americans met all six markers of a middle-class lifestyle. While about 9 in 10 Americans had health insurance, only three-quarters had health insurance and a steady job. With each added measure of financial security, more Americans slipped away from the middle-class ideal.

About a third of Americans meet middle class criteria

About 90 percent of Americans agreed that these six individual conditions were necessary to belong to the middle class, according to a Washington Post poll

American adults ...

... with health insurance ...

... and steady employment ...

... who can save for

the future...

... pay their bills ...

... afford

emergency

expenses ...

... and retire

comfortably.

35% meet all 6

65% do not meet all

middle class criteria

Source: 2022 Survey of Household Economics

and Decisionmaking

About a third of Americans meet middle class criteria

About 9 in 10 Americans agreed that these six conditions were necessary to belong to the middle class, according to a Washington Post poll

American adults ...

100%

91% of

American

adults

... with health insurance ...

... and steady employment ...

75%

... who can save for the future...

67%

... pay their bills ...

56%

... afford emergency

expenses ...

45%

... and retire

comfortably.

35%

65% do not meet all

middle class criteria

35% meet all 6

Source: 2022 Survey of Household Economics and Decisionmaking

About a third of Americans meet middle class criteria

About 90 in 10 Americans agreed that these six individual conditions were necessary to belong to the middle class, according to a Washington Post poll

100%

American adults ...

91% of American

adults

... with health insurance ...

75%

... and steady employment ...

67%

... who can save for the future...

56%

... pay their bills without worry ...

... afford emergency

expenses ...

45%

... and retire

comfortably.

35%

35% meet all 6 criteria

65% do not meet all 6 middle class criteria

Source: 2022 Survey of Household Economics and Decisionmaking

About a third of Americans match popular image of the middle class

About 9 in 10 Americans agreed that these six individual conditions were necessary to belong to the middle class, according to a Washington Post poll

... and retire

comfortably.

... afford emergency

expenses ...

... pay bills

without worry ...

35%

... who can save

for the future...

45%

... and steady

employment ...

56%

... with health

insurance ...

35% meet

all 6 criteria

67%

American

adults ...

75%

91%

100%

65% do not

Source: 2022 Survey of Household Economics and Decisionmaking

Researchers often define the middle class based on income, in part because income data is frequently collected and easy to access. But that income doesn’t guarantee a middle-class lifestyle.

One commonly used definition from the Pew Research Center sets a middle-class income between two-thirds and twice the national median income, or $67,819 to $203,458 for a family of four in 2022. Most Americans consider the lower end of that range, $75,000 and $100,000, to be middle class, according to the Post poll.

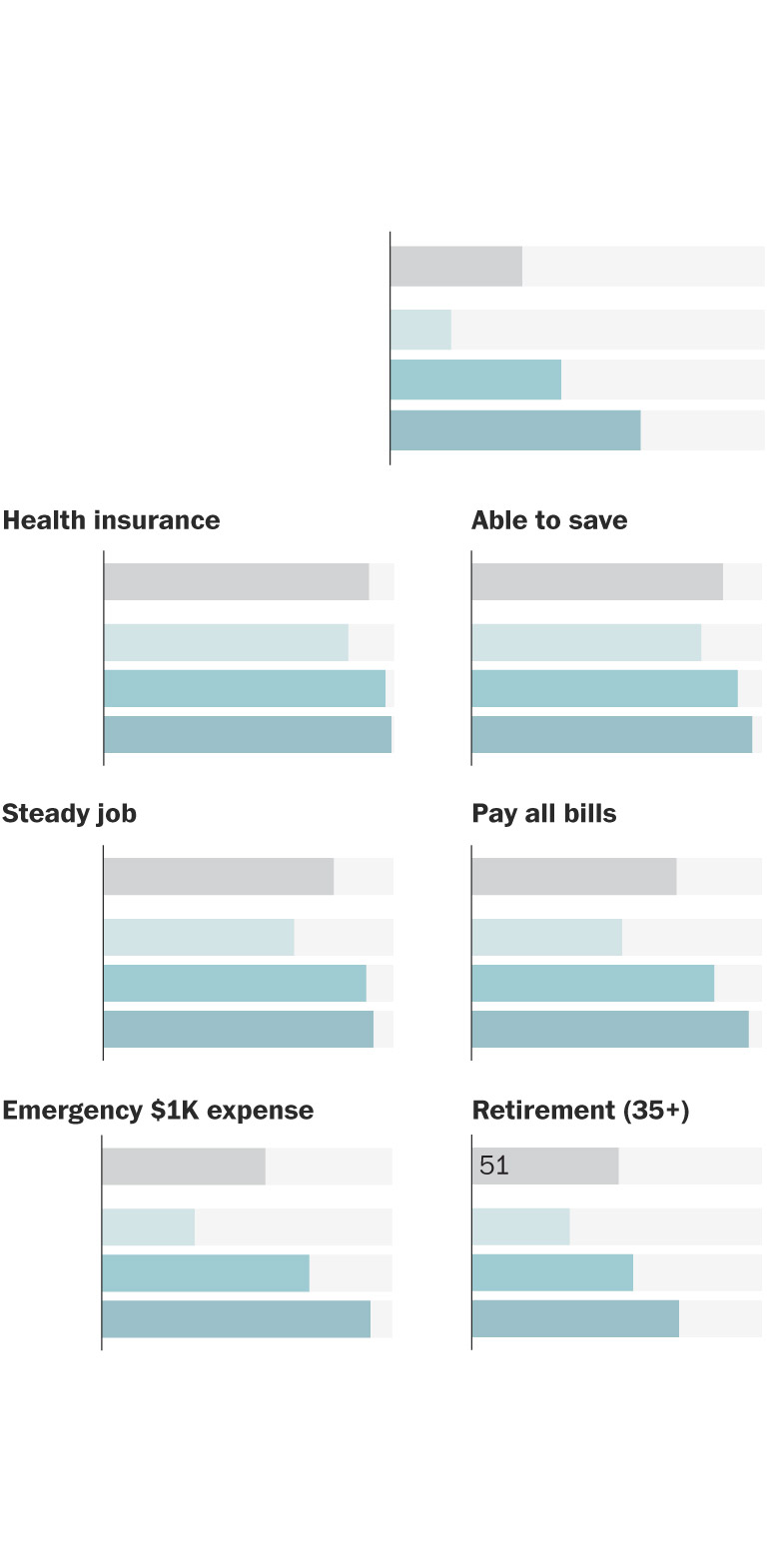

Even when looking at middle-income Americans using Pew’s more expansive range, the majority did not have the security associated with the middle class.

Those that did tended to be older, had higher incomes and were more likely to have a college education and own their homes. While the Post poll found 60 percent of Americans considered homeownership essential to being middle class, homeowners over age 30 were more likely to be financially secure even when comparing people with similar ages and incomes, according to a Federal Reserve survey.

The most common barrier was a comfortable retirement, something that about half of middle-income Americans over 35 felt they were on track to achieve.

Most middle-income people lack

middle-class financial security

Percent of Americans that meet criteria

in each income group

Meets all criteria

35%

U.S. adults

Lower income

16

Middle income

46

Upper income

67

Health insurance

Able to save

Overall

91%

87

Lower

84

79

Middle

97

92

Upper

99

97

Steady job

Pay all bills

Overall

79%

71

Lower

66

52

Middle

91

84

Upper

93

95

Emergency $1K expense

Retirement (35+)

Overall

56%

51

Lower

32

34

Middle

71

56

Upper

93

72

Lower income for a family of 4 is defined as a household income of $68K or below, middle income is between $68K and $203K, and upper income is above $203K. Percent meeting

retirement criteria reflects only people 35 and older; younger people did not have to meet the retirement criteria to meet the full definition.

2022 Survey of Household Economics and Decisionmaking

Most middle-income people lack

middle-class financial security

Percent of Americans that meet criteria in each

income group

Meets all criteria

35%

U.S. adults

Lower income (under $68K)

16

Middle income ($68K-$203K)

46

Upper income (above $203K)

67

Health insurance

Able to save

Overall

91%

87

Lower

84

79

Middle

97

92

Upper

97

99

Steady job

Pay all bills

Overall

79%

71

Lower

66

52

Middle

91

84

Upper

93

95

Emergency $1K expense

Retirement (35+)

56%

51

Overall

Lower

32

34

71

56

Middle

93

72

Upper

All incomes adjusted for a household size of 4. Percent meeting retirement criteria reflects only people 35 and older; younger people did not have to meet the retirement criteria to meet the full definition.

2022 Survey of Household Economics and Decisionmaking

Most middle-income people lack middle-class financial security

Percent of Americans that meet criteria in each income group

Meets all criteria

35%

Americans overall

16

Lower income (under $68K)

46

Middle income ($68K to $203K)

67

Upper income (over $203K)

Health insurance

Able to save

Overall

91%

87

Lower

84

79

Middle

97

92

Upper

99

97

Steady job

Pay all bills

Overall

79%

71

Lower

66

52

Middle

91

84

Upper

93

95

Pay emergency $1K expense

Comfortable retirement (35 or older)

56%

51

Overall

Lower

32

34

71

56

Middle

Upper

93

72

All incomes adjusted for a household size of 4. Percent meeting retirement criteria reflects only people 35

and older; younger people did not have to meet the retirement criteria to meet the full definition.

Source

:

2022 Survey of Household Economics and Decisionmaking

Gallup polling last spring found that retirement was Americans’ top financial worry. Even for those who can save, retirement planning requires complicated judgments about how long someone expects to live and the future of government support through programs such as Social Security and Medicare.

“The de facto landscape now for retirement is to save like hell and hope you don’t live too long,” said Ben Harris, vice president and director of economic studies at Brookings. “And that’s a terrible paradigm.”

The shift from defined benefit plans to individual retirement accounts has increased the importance of saving for retirement, at the same time as rising housing and student loan payments are taking up a growing share of income, according to Annamaria Lusardi, senior fellow at the Stanford Institute for Economic Policy Research.

“There was a time in which family income was a lot more defining about your life and your financial security,” Lusardi said. “But now you are in charge of much more of your future, particularly in terms of the financial decisions that people have been asked to make.”

While the path to middle-class financial security has become more complicated, the share of people with it hasn’t markedly declined over time.

Since 2017, the earliest year of comparable data, between 32 and 40 percent of Americans met all six measures, with a low in 2017 and a high in 2021.

Another survey, the Federal Reserve’s Survey of Consumer Finances, provides a broader view of American financial stability back to the 1980s. More Americans today have $1,000 in liquid savings than they did 40 years ago, after adjusting for inflation. And the share of Americans with money in a retirement or pension account has held steady over the past 40 years.

“The idea that you can have a secure job with predictable wages, with health care and retirement, and being able to pay for your housing — those things are all part of a mid-century vision of the middle-class life trajectory,” said Zaloom, the anthropologist.

“Even in the 1960s, the idea that this was a very widespread phenomenon was always kind of a fiction,” she added.

The draw of the middle class is rooted in far more than the desire for financial security.

“It’s the perfect model of American identity,” said cultural historian Larry Samuel, author of “The American Middle Class: A Cultural History.” “It fits so well with our ethos of egalitarianism and being a meritocracy. These are all myths, of course, but they’re embedded in how we see ourselves.”

“It’s a club that everyone kind of wants to be a part of,” Samuel said, “regardless of your economic circumstances.”

About this story

Sonia Vargas and Dylan Moriarty contributed to this report.

This Washington Post poll was conducted Nov. 3-6, 2023, among a national sample of 1,280 U.S. adults with an error margin of plus or minus 3.7 percentage points. The sample was drawn through SSRS’s Opinion Panel, an ongoing survey panel recruited through random sampling of U.S. households. To enable subgroup comparisons, the survey included oversamples of households with lower incomes. This and other groups were weighted back to their share of the adult population according to the U.S. Census Bureau.

The definitions of low, middle and upper household incomes are based on values from the 2023 Annual Social and Economic Supplement to the Current Population Survey. All household incomes are adjusted for size via an equivalence adjustment scale, following the Pew Research Center’s methodology.

Analysis of the financial security of American households uses data from the Federal Reserve’s Survey of Household Economics and Decisionmaking (SHED) and the Survey of Consumer Finances (SCF).

The middle class criteria were defined as follows for each survey:

- Steady job: had a non-temporary job or were already retired (SHED 2017-2022); working, retired, disabled, student or homemaker (SCF).

- Cover emergency expenses: could pay a $1,000 emergency expense using only their savings (SHED 2022 for point in time analysis); would pay a $400/500 emergency expense using their savings or a credit card they would pay off in full at the end of the month (SHED 2017-2022 for historical analysis); had at least $1,000 in liquid assets (SCF).

- Pay bills: were able to pay all their bills in full during the month of the survey and would be able to pay those bills even if they had had to pay an emergency expense of $400 or $500 (SHED 2017-2022); no late debt payments in the last year (SCF).

- Health insurance: had health insurance (SHED 2017-2022); not applicable for SCF.

- Comfortable retirement: feel that their retirement savings are on track, or are already retired and feel they are doing at least okay financially; individuals under 35 did not have to meet this criteria to be considered middle class (SHED 2017-2022); any amount in retirement savings or pension accounts (SCF).

- Save for the future: spent no more than their household income in the last month or has a rainy-day fund that can cover three months of expenses (SHED 2017-2022); saved over the last 12 months (SCF)