How your holiday diamond may be funding Russia’s war

About a third of the world’s diamonds come from Russia, earning the Kremlin at least a billion dollars a year as it wages war in Ukraine.

America spends more on diamonds than anywhere else, accounting for more than half of all global sales. December is peak season.

The journey of a diamond from a Russian mine to a U.S. jewelry counter can be complicated — which makes it tough to trace.

More than 90 percent of Russia’s diamonds come from Alrosa, a state-controlled mining company. The United States banned the import of Russian diamonds and imposed sanctions on Alrosa in response to the invasion of Ukraine. But sales have remained strong. The company’s revenue was $1.9 billion in the first half of this year.

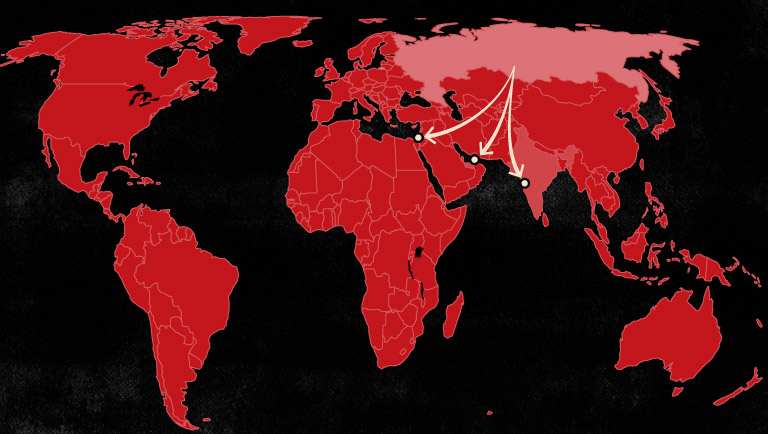

Before the war in Ukraine, most Russian diamonds were traded through Antwerp, Belgium, the historical capital of the global diamond trade. The European Union is only now moving toward a ban.

Possibly in anticipation, Russia has started favoring other trade hubs, including Dubai, Mumbai and Ramat Gan, Israel. Small rough diamonds are sometimes bundled and rebundled to create better-selling assortments, changing hands multiple times, analysts say.

Eventually, more than 9 out of 10 of the world’s jewelry-grade diamonds pass through the Indian city of Surat, where they are cut and polished. That brings out the brilliance of the stones. It also transforms their classification.

Diamonds can enter India as “Russian” and leave as “Indian” — and be sold in the United States and elsewhere.

(Sarah Hashemi/TWP)

(Sarah Hashemi/TWP)

Isn’t there already a system to block “blood diamonds”? Yes. But the official definition of conflict diamonds are those that help fund the efforts of rebel groups to undermine governments. Russian-origin diamonds don’t count.

Some big players in the jewelry industry — including Tiffany & Co., Cartier and Chopard — pledged to avoid Russian diamonds. But some question whether companies can or should police their own supply chains.

The Group of Seven countries and the E.U. have agreed to try to close the loopholes and keep Russian diamonds out of their markets. They say that by Jan. 1 they will restrict diamonds imported from Russia and by March will begin to extend restrictions to Russian diamonds processed in other countries.

Some experts remain skeptical. The G-7 will need cooperation from other key players, particularly India. And the plan’s effectiveness hinges on the widespread, potentially costly adoption of what is now niche digital-tracing technology.

The plan at least initially applies only to diamonds over 1 carat. That might include the featured stone in an average U.S. engagement ring, but not the smaller diamonds that line the band. Russia is known for its small diamonds.

So, this holiday and engagement season, Russian diamonds will still be circulating in the United States and Europe. “Russian diamonds are not forever,” European Council President Charles Michel has said. But they will still enrich the Kremlin for some time to come.

About this story

Editing by Marisa Bellack and Reem Akkad. Videos and animations by Sarah Hashemi, Lindsey Sitz, and Ross Goodwin. Design and development by Aadit Tambe.

The data for diamond production came from Kimberly Process.