The underbelly of electric vehicles

What goes into making EVs, where it comes from and at what human cost

While electric vehicles are essential to reducing carbon emissions, their production can exact a significant human and environmental cost. To run, EVs require six times the mineral input, by weight, of conventional vehicles, excluding steel and aluminum.

These minerals, including cobalt, nickel, lithium and manganese, are finite resources. And mining and processing them can be harmful for workers, their communities and the local environment.

EVs have already secured a prominent place on our roads: They account for more than 10 percent of new-car sales globally. Recent U.S. legislation and regulations are expected to further increase demand.

Projections show global EV sales surpassing gas-vehicle sales before 2040.

The trend is expected to greatly reduce emissions from transportation, which now represent 14 percent of the global total each year.

As the demand for EVs rises, so will the demand for the minerals inside their batteries.

Your EV might look like a normal sedan or SUV from the outside.

But underneath the floor of your car is an approximately 900-pound battery block containing materials that have been mined from the ground, sent around the world and put through complex chemical processing to fuel your ride from point A to point B.

That supply chain has a significant human and environmental toll.

“If you are going to take a look at any source of energy, you always will have some trade-offs,” said Sergey Paltsev, a senior research scientist at MIT. “There is no magic solution.”

One of the most common batteries on the road, the NMC, used by companies including Volkswagen, Mercedes and Nissan, contains significant amounts of aluminum, nickel, cobalt, manganese and lithium.

But while batteries may vary in composition, they generally rely on the same set of materials.

Where the minerals are

The five minerals most critical to EV batteries are each concentrated in just a handful of countries. For these countries, the EV boom holds enormous economic promise, but also environmental, social and workplace challenges that have yet to be addressed.

Bauxite

100M metric tons

Top bauxite-

producing countries

50M

5M

Countries with the

largest known reserves

Guinea

Guinea has 7.4B metric

tons of reserves, the

largest in the world

100M metric tons

Top bauxite-

producing countries

50M

Countries with the

largest known reserves

5M

Guinea

Guinea has 7.4B metric tons

of reserves, the largest in the world

Top bauxite-producing countries

Countries with the largest known reserves

Russia

Kazakhstan

Saudi

Arabia

China

Guinea

Jamaica

India

Brazil

Indonesia

100M

metric tons

Guinea has

7.4B metric tons

of reserves, the

largest in the world

50M

Australia

5M

Top bauxite-producing countries

Countries with the largest known reserves

Russia

Kazakhstan

Guinea has

7.4B metric tons

of reserves, the

largest in the world

China

Saudi

Arabia

Jamaica

India

Guinea

Indonesia

100M

metric tons

Brazil

50M

Australia

5M

Top bauxite-producing countries

Countries with the largest known reserves

Russia

Kazakhstan

Guinea has

7.4B metric tons

of reserves, the

largest in the world

China

Saudi

Arabia

Jamaica

India

Guinea

Indonesia

100M

metric tons

Brazil

50M

Australia

5M

Production

Bauxite, a reddish rock that is processed to produce aluminum, is mostly mined in Australia, China and Guinea. The lightweight metal enables EVs to travel farther without recharging than if they were made of steel. Aluminum is also one of the most essential minerals in EV batteries.

Reserves

Guinea, one of the world’s poorest countries, sits on Earth’s largest bauxite reserves. By 2030, demand for aluminum will jump nearly 40 percent, to 119 million tons annually, industry analysts say. But the boom is taking a toll on the people who live on the land. Guinea’s government says hundreds of square miles once used for farming have been acquired by mining companies for their operations and associated roads, railways and ports. Villagers have received little or no compensation, locals and rights activists say.

Nickel

1.6M

metric tons

Top nickel-

producing countries

200K

Countries with the

largest known reserves

20K

Indonesia

Indonesia is the top producer of

nickel and has one of the largest

known reserves in the world

1.6M metric tons

Top nickel-

producing countries

Countries with the

largest known reserves

200K

20K

Indonesia

Indonesia is the top producer of

nickel and has one of the largest

known reserves in the world

Top nickel-producing countries

Countries with the largest known reserves

Russia

Canada

China

U.S.

Philippines

1.6M

metric tons

Brazil

Indonesia

New

Caledonia

Australia

Indonesia is the top producer of

nickel and has one of the largest

known reserves in the world

200K

20K

Top nickel-producing countries

Countries with the largest known reserves

Russia

Canada

China

U.S.

Philippines

Brazil

1.6M

metric tons

Indonesia

New Caledonia

Australia

Indonesia is the top producer of

nickel and has one of the largest

known reserves in the world

200K

20K

Top nickel-producing countries

Countries with the largest known reserves

Russia

Canada

China

U.S.

Philippines

Brazil

1.6M

metric tons

Indonesia

New Caledonia

Australia

Indonesia is the top producer of

nickel and has one of the largest

known reserves in the world

200K

20K

Production

Indonesia is the world’s top miner of nickel by a wide margin, and if trends continue, it will produce more than two-thirds of the global nickel supply by 2030. Global demand for nickel is expected to increase nearly 20-fold by 2040, and Indonesian officials have approved the construction of nine new nickel smelters in an attempt to capitalize on the boom — with tariffs and export bans to maximize profits at home.

But local communities are fearful of the effects of extraction and processing on their environment.

Reserves

Sixty percent of the world’s nickel reserves are concentrated in three countries: Indonesia, Australia and Brazil. China’s proximity to the nickel-rich nations in the South Pacific has brought in foreign investment that will probably drive growth despite the environmental drawbacks.

Manganese

Top manganese-

producing countries

7.2M metric tons

Countries with the

largest known reserves

1M

500K

South

Africa

South Africa is the world’s

top producer of manganese

and has the largest known

reserves

Top manganese-

producing countries

7.2M metric tons

Countries with the

largest known reserves

1M

500K

South

Africa

South Africa is the world’s top

producer of manganese

and has the largest known

reserves

Top manganese-producing countries

Countries with the largest known reserves

Ukraine

China

Ghana

India

Ivory Coast

Malaysia

Gabon

Brazil

7.2M

metric tons

Australia

South

Africa

South Africa is the world’s

top producer of manganese

and has the largest known

reserves

1M

500K

Top manganese-producing countries

Countries with the largest known reserves

Ukraine

China

Ghana

India

Ivory Coast

Gabon

Malaysia

Brazil

7.2M

metric tons

Australia

South Africa is the world’s top

producer of manganese

and has the largest known

reserves

1M

South Africa

500K

Top manganese-producing countries

Countries with the largest known reserves

Ukraine

China

Ghana

India

Ivory Coast

Malaysia

Gabon

Brazil

7.2M

metric tons

Australia

South Africa is the world’s

top producer of manganese

and has the largest known

reserves

1M

South Africa

500K

Production

South Africa’s mines produce more than one-third of the world’s manganese supply, and analysts predict that global demand from the battery sector will increase ninefold over the next decade as EV suppliers use high-purity manganese to increase battery efficiency and reduce combustibility.

Workers in these mines say they have experienced memory loss, slurred speech and other physical impairments tied to ingesting the mineral’s fine dust.

Reserves

South Africa also sits on the world’s largest reserves of manganese. Ukraine has the fourth-largest known reserves. One manganese basin rests in the country’s south, which Russia continues to bombard in its invasion.

Lithium

Top lithium-

producing countries

60K metric tons

20K

Countries with the

largest known reserves

5K

Afghanistan’s lithium

reserves may rival the

current largest known

reserves in South America

Top lithium-

producing countries

60K metric tons

20K

Countries with the

largest known reserves

5K

Afghanistan’s lithium

reserves may rival the

current largest known

reserves in South America

Top lithium-producing countries

Countries with the largest known reserves

Canada

Portugal

China

Afghanistan’s lithium

reserves may rival the

current largest known

reserves in South America

60K

metric tons

Chile

Zimbabwe

Australia

20K

Argentina

5K

Top lithium-producing countries

Countries with the largest known reserves

Canada

Portugal

China

Afghanistan’s lithium

reserves may rival the

current largest known

reserves in South America

Zimbabwe

60K

metric tons

Australia

Chile

20K

Argentina

5K

Top lithium-producing countries

Countries with the largest known reserves

Canada

Portugal

China

Afghanistan’s lithium

reserves may rival the

current largest known

reserves in South America

Zimbabwe

60K

metric tons

Australia

Chile

Argentina

20K

5K

Production

Lithium’s reactivity and lightness enable EVs to generate the same energy and speed as gas-powered vehicles. Demand for lithium is expected to increase 40-fold by 2040, with 80 percent of that demand driven by EVs, according to the Natural Resources Defense Council. Australia, Chile and China lead in lithium mining.

Reserves

Three of the largest current reserves are concentrated in South America’s “lithium triangle,” where arid salt flats in Argentina, Bolivia and Chile make it easy to extract lithium by simply evaporating the basins’ brine water. Increased lithium demand threatens to exhaust the region’s limited water supply, displacing Indigenous communities and disrupting the fragile ecology.

There may soon be another supplier. Afghanistan holds untapped lithium that may rival the world’s largest known reserves. China has expressed interest in working with the Taliban government to tap those reserves.

Cobalt

Top cobalt-

producing countries

130M metric tons

Countries with the

largest known reserves

10K

Democratic

Republic of Congo

The largest known

cobalt reserves are in

the Democratic Republic

of Congo

130M metric tons

Top cobalt- producing countries

Countries with the largest known reserves

10K

Democratic

Republic of Congo

The largest known

cobalt reserves are in

the Democratic Republic

of Congo

Top cobalt-producing countries

Countries with the largest known reserves

Russia

Canada

Turkey

Morocco

Cuba

Democratic

Republic of Congo

Philippines

Papua New

Guinea

Indonesia

Australia

The largest known

cobalt reserves are in

the Democratic Republic

of Congo

130M

metric tons

10K

Top cobalt-producing countries

Countries with the largest known reserves

Russia

Canada

Turkey

Morocco

Cuba

Democratic

Republic of Congo

Philippines

Indonesia

Papua New

Guinea

The largest known

cobalt reserves are in

the Democratic Republic

of Congo

Australia

130M

metric tons

10K

Top cobalt-producing countries

Countries with the largest known reserves

Russia

Canada

Turkey

Morocco

Cuba

Democratic

Republic of Congo

Philippines

Indonesia

Papua New

Guinea

The largest known

cobalt reserves are in

the Democratic Republic

of Congo

Australia

130M

metric tons

10K

Production

Demand for cobalt is expected to increase 20-fold by 2040.

Seventy percent of the world’s cobalt is mined in the Democratic Republic of Congo. State-owned and Chinese mining companies dominate the sector. But 15 percent of Congo’s mining operations are in the informal sector, with more than 200,000 people working in unregulated and poorly ventilated mines.

The U.S. Labor Department estimates that between 5,000 and 35,000 children, some as young as 6, work in these unregulated operations.

Reserves

Congo is also sitting on the world’s largest reserves. As demand for cobalt rises, activists are calling for better monitoring and regulation.

“Any truly ethical response to this problem would not support disengagement from [Congo] or involve the boycotts of its cobalt,” wrote Mark Dummet, the head of business and human rights at Amnesty International. “Instead, what we, as activists, consumers, auto makers, mining companies and governments alike need to be pushing for are practical solutions that place human rights at the heart of the energy transition.”

China’s grip on the supply chain

Taking the minerals out of the ground is only the first step. The ore is almost never pure and needs to be refined, or processed, to become the minerals that go into batteries.

When it comes to processing, there is one major player: China, which handles more than half of the minerals critical to EV batteries. These elements aren’t used only to power EVs; they also appear in everything from building materials to toys. But as the demand for EV components soars, so could dependency on China’s refining infrastructure.

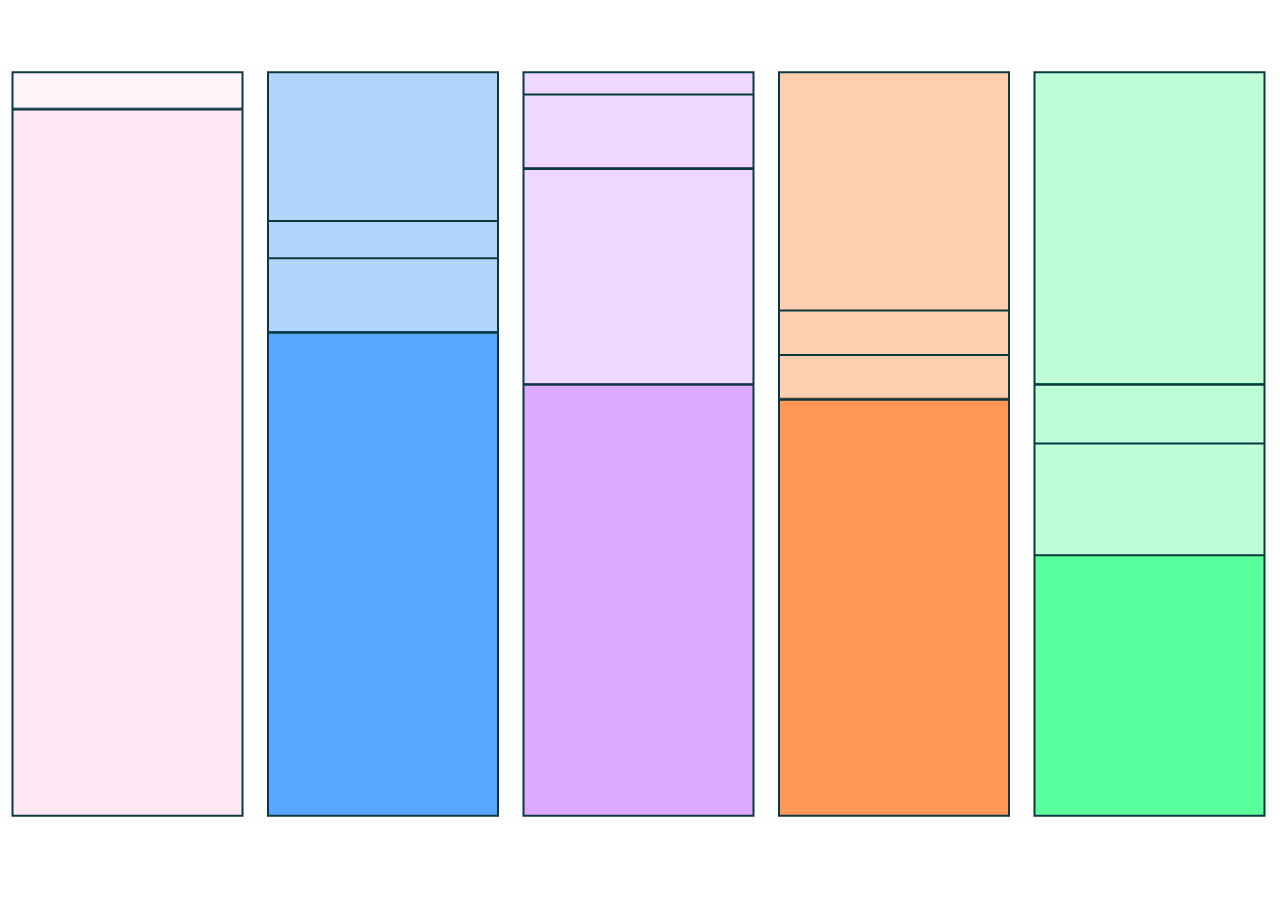

Percent of minerals refined or processed

China

95%

China

65%

China

58%

China

56%

China

35%

MANGANESE

COBALT

LITHIUM

ALUMINUM

NICKEL

Percent of minerals refined or processed

Argentina 10%

China 95%

Belgium 5%

Chile 29%

Finland 10%

Russia 6%

China 65%

India 6%

Japan 8%

China 58%

China 56%

Indonesia

15%

China 35%

MANGANESE

COBALT

LITHIUM

ALUMINUM

NICKEL

Percent of minerals refined or processed

Argentina 10%

China 95%

Others 20%

Others 32%

Others 42%

Belgium 5%

Chile 29%

Finland 10%

Russia 6%

China 65%

India 6%

Japan 8%

China 58%

China 56%

Indonesia 15%

China 35%

MANGANESE

COBALT

LITHIUM

ALUMINUM

NICKEL

The United States is trying to expand its supply chain. The 2022 Inflation Reduction Act offers a tax credit of up to $7,500 to consumers under certain income levels who buy qualifying EVs. But beginning in 2025, an EV that contains any minerals sourced or processed in China would not qualify for the full credit. This poses a problem for cost-conscious consumers, as Beijing controls the lion’s share of the world’s processing infrastructure, and 75 percent of the world’s battery production capacity, according to the International Energy Agency.

In the short term, EV buyers may have trouble securing the tax credits designed to incentivize a clean-energy transition. But over time, such policies could help diversify the EV supply chain.

“We still are going to be dependent on China for many, many years,” Paltsev said.